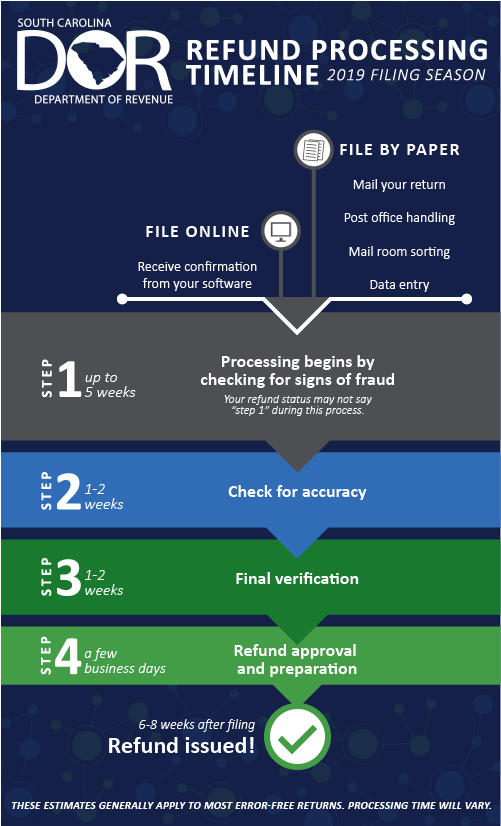

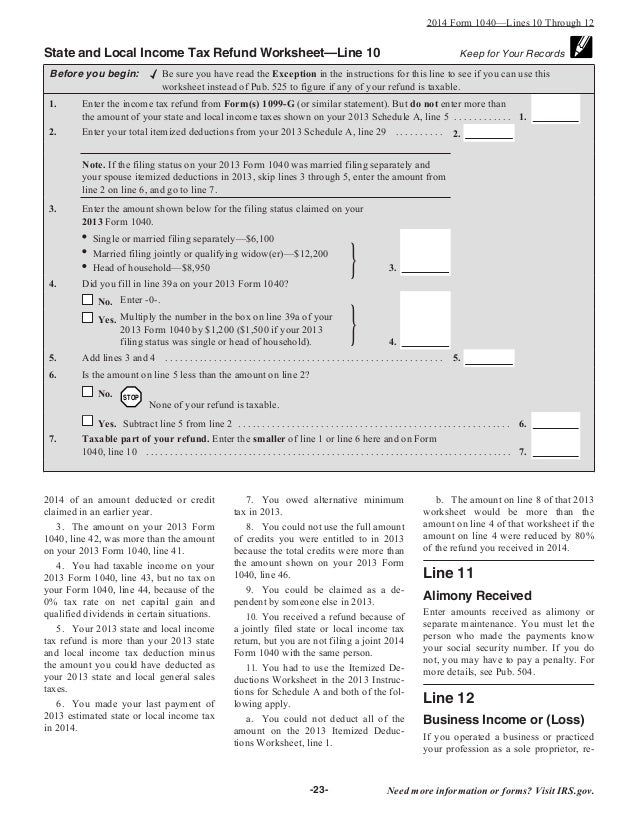

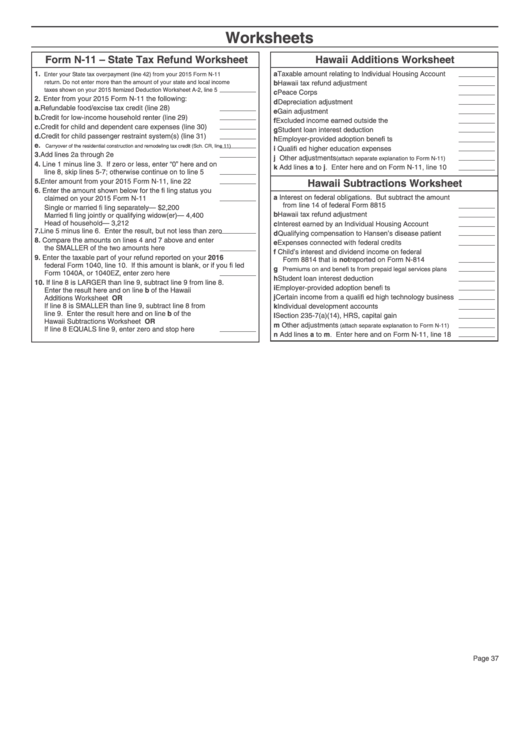

State Tax Refund Worksheet. The State Refund Worksheet in the return reflects the calculation of the amount (if any) of the state income tax. Each tax return is different, so processing time will vary.

I have not been able to figure out how this number was calculated.

In most cases, it is avoidable.

You do not need to amend the prior years. Make sure you use the State Tax Refund Worksheet included in the Taxslayer Program to determine if your state refund in taxable. State Tax Refund worksheet is used to determine how much (if any) of your previous year(s) State Tax Refund is included in taxable income for the current tax If you did not itemize your deductions on Schedule A during the year the State Refund pertains to, none of the refund will be included in your.