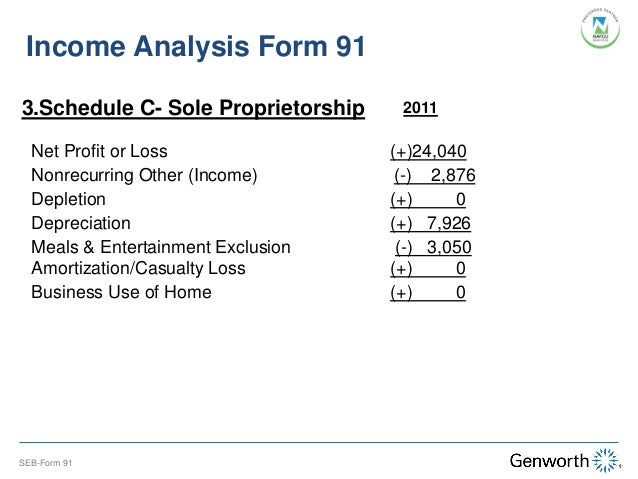

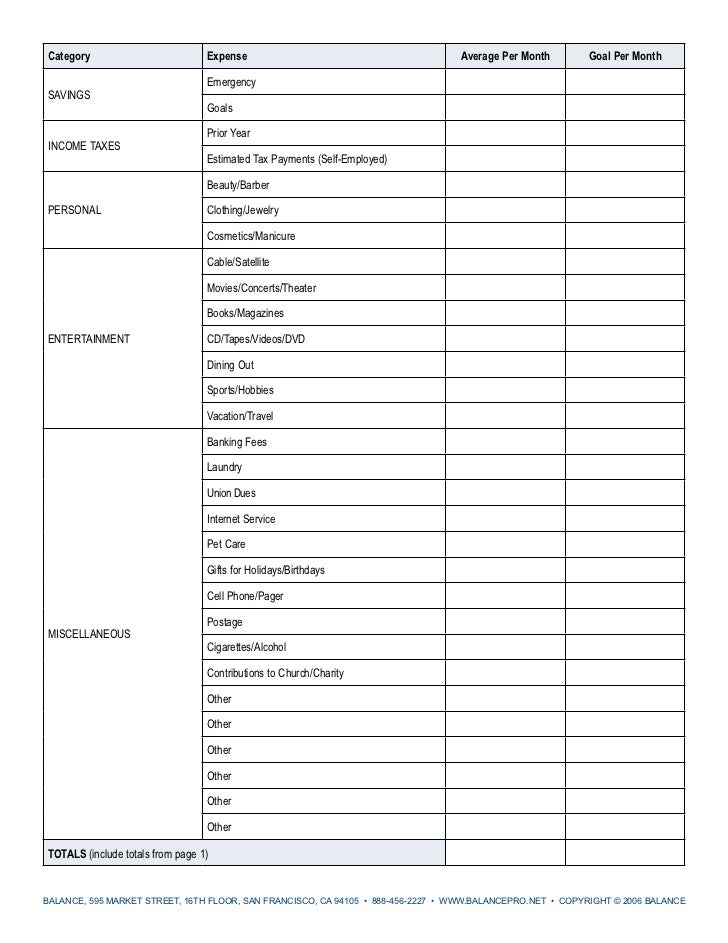

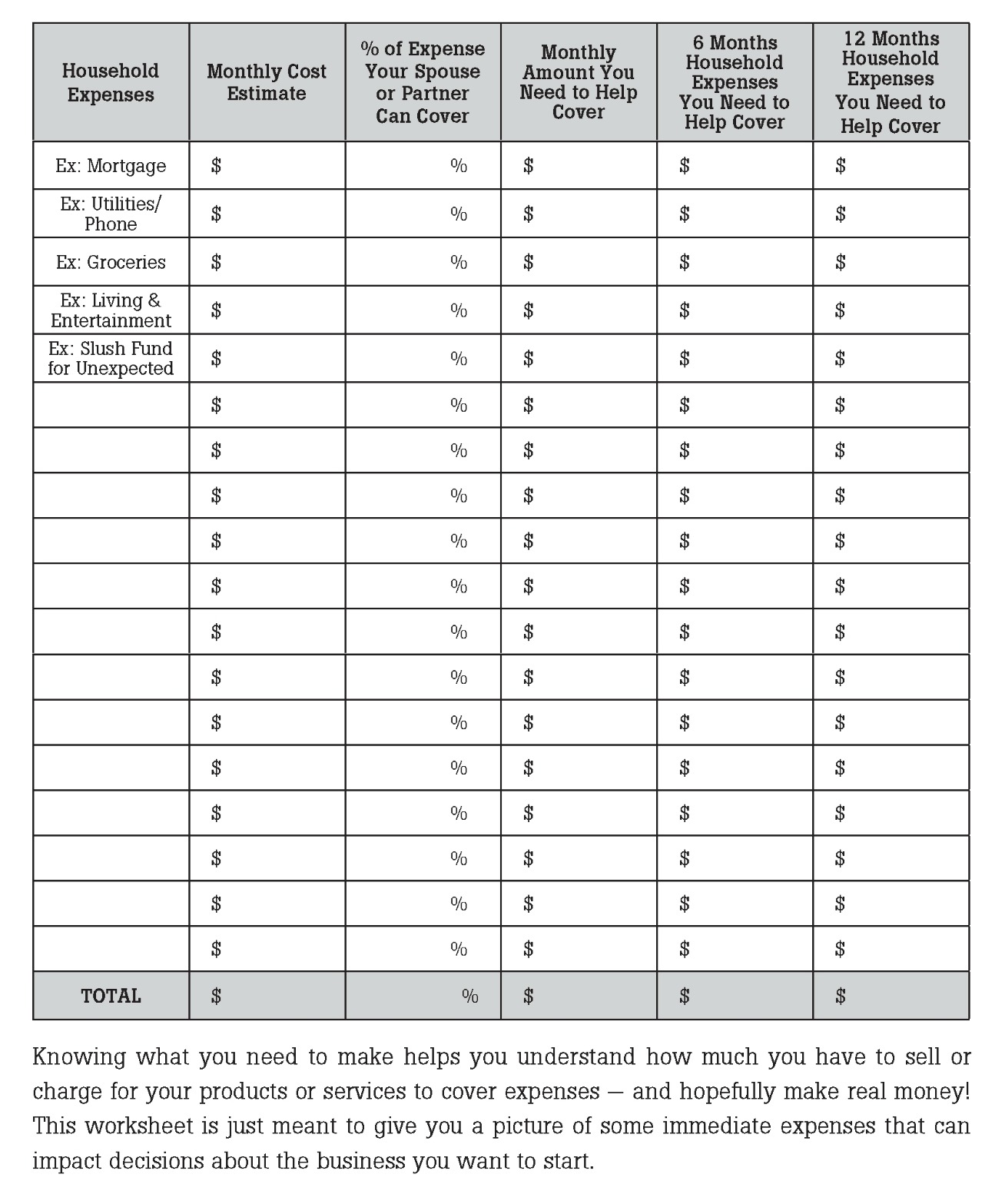

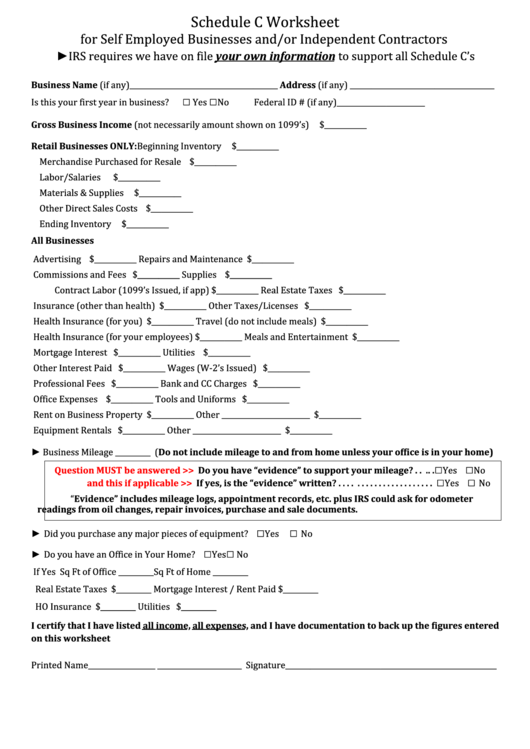

Self Employed Income Analysis Worksheet. Correctly evaluating the income of self-employed borrowers is a challenge for mortgage lenders and underwriters, who are under more regulatory pressure than To meet the need for a simple, accurate process, MGIC has developed its editable Cash Flow Worksheets, which guide users through an. Our cash flow analysis worksheets promote ease and accuracy in determining.

This is so we can calculate the amount of Universal Credit you receive each month.

Income verification letter for self employed - self employment verification form.

The problem with that is reducing tax liabilities minimizes taxable income and makes qualifying for a loan more challenging. As business owners, self-employed borrowers' goal is to maximize income yet reduce tax liability. Bad debts you recovered if they were written off on. • The self-employed as a group have seen falling income since the recession. • But this is mostly down to the changing composition of self-employment.